Return on investment (ROI) is a metric used to understand the profitability of an investment. It compares how much you paid for an investment to how much you earned, to evaluate its efficiency.

ROI may be used to evaluate investment portfolios, or it can be applied to assess almost any type of expenditure. For example, you could use ROI to calculate the return on the cost of advertising.

Let’s take a look at how it’s used by both individual investors and businesses.

Simple ROI

The most common way to calculate ROI is to take net income divided by the total cost of the investment.

ROI = Net income / Cost of investment x 100

![]()

For instance, if you’ve spent $10,000 on advertising and generated $50,000 in sales, you would be getting a 400% ROI on the ad expenditure.

You write ROI as a percentage. The greater the percentage, the better the investment.

Accurate ROI calculations depend on factoring in all costs, not merely the initial cost of the investment itself. Transaction costs, taxes, maintenance costs and other ancillary expenditures should be included in your calculations.

How ROI can help you

As a small business owner, ROI calculations can help your company. Your return on investment could help you secure outside funding. A strong return on investment can reduce the risk for investors. If you are applying for a small business loan, your ROI could show that you can pay back lenders.

Your return on investment can also help you operate your business more efficiently. You can use the formula to see how successful your investments are. For example, let’s say you ran a marketing campaign on the radio and in the newspaper. You can use the ROI of both methods to see which brought in a higher return.

Universally Understood

Return on investment is a universally understood concept so it’s almost guaranteed that if you use the metric in conversation, then people will know what you’re talking about.

Simple and Easy to Calculate

The return on investment metric is frequently used because it’s so easy to calculate. Only two figures are required – the benefit and the cost. Because a “return” can mean different things to different people, the ROI formula is easy to use, as there is not a strict definition of “return”.

Drawbacks to the simple ROI formula is that it disregards the factor of time.

Annualized ROI

A higher ROI number does not always mean a better investment option. For example, two investments have the same ROI of 50%. However, the first investment is completed in three years, while the second investment needs five years to produce the same yield. Both investments have the same ROI, but one is clearly the better option.

ROI should be compared under the same time period and same circumstances.

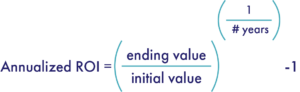

To include time as a factor in ROI you can calculate an annualized ROI.

Annualized ROI Formula

Where # of years = number of days / 365

Predicting ROI

An ROI calculation that depends on estimated future values, but does not include any kind of assessment for risk, can be a problem for investors. It is easy to be tempted by high potential ROIs. But the calculation itself does not give any indication of how likely that kind of return will be.